The Labor Department released its monthly jobs report for April Friday morning at 8:30 a.m. ET. Here were the main metrics from the print, compared with consensus data compiled by Bloomberg:

Non-farm payrolls: +428,000 vs. +380,000 expected and a revised +428,000 in March

Unemployment rate: 3.6% vs. 3.5% expected, 3.6% in March

Average hourly earnings, month-over-month: 0.3% vs. 0.4% expected and a revised 0.4% in March

Average hourly earnings, year-over-year: 5.5% vs. 5.5% expected, 5.6% in March

The U.S. economy has brought back payrolls each month so far in 2022, and April's payrolls gains still represented growth well-above pre-pandemic trends. Throughout 2019, payroll growth had averaged about 164,000 per month. And though payroll gains were also slightly downwardly revised for February and March, these increases were still solid on a historical basis. In February, employment grew by 714,000, versus the 750,000 previously reported, while March employment was downwardly revised by 3,000 to reach 428,000.

Services-based employers have brought back some of the most jobs yet again in April, as companies hastened to hire back workers let go during the pandemic to meet renewed consumer demand. Employment in the leisure and hospitality industry increased by 78,000 in April, slowing just slightly from March's 100,000. Education and health services employers brought back slightly more jobs in April compared to March at 59,000. Transportation and warehousing payroll gains increased much more markedly in April compared to March, rising by 52,000 compared to 9,500 during the prior month.

In the goods-producing sector, payroll growth was little changed month-on-month, with jobs growing by 66,000 in April. This was in turn led by hiring in manufacturing, where payrolls grew 55,000.

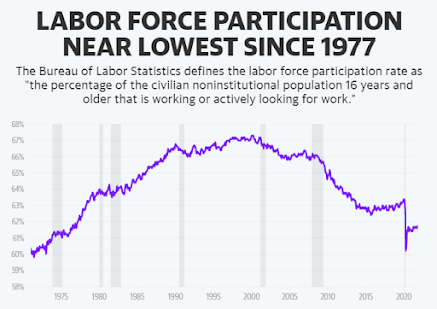

Meanwhile, the unemployment rate held steady in April at 3.6%, or just a hair above February 2020's level of 3.5% from before the pandemic. That, in turn, had been the lowest level for joblessness since 1969. And this came as the labor force participation rate unexpectedly dipped to 62.2% from March's 62.4%, suggesting a smaller share of the population was either employed or actively seeking work.

"Almost 500,000 workers decided to leave the workforce in April. The large decline is a concerning prospect for businesses that are facing one of the tightest labor markets in decades," Peter Essele, Head of Portfolio Management for Commonwealth Financial Network, said in an email Friday morning. "Currently, there are 11.5 million job openings and only 5.9 million unemployed, causing a large mismatch in labor supply and demand that’s fueling wage growth. A further decline in the participate rate could exacerbate the labor supply shortage, resulting in further wage pressures that will inevitably flow through to broad-based inflation."

Wages also climbed yet again, albeit at a slower monthly and annual pace compared to March. On a month-over-month basis, average hourly earnings increased by 0.3%, slowing from March's upwardly revised 0.5% increase. And on a year-over-year basis, average hourly earnings were up 5.5%.

The recent increases in payrolls and wages and decrease in the unemployment rate, however, have not given rise to a commensurate improvement in the financial wellbeing of many Americans. With inflation running at 40-year highs, price increases for consumer goods have outpaced earnings growth. The U.S. Consumer Price Index (CPI) last rose at an 8.5% year-on-year rate in March or the fastest since 1981, according to the Bureau of Labor Statistics.

"So many people seemed to be banking that if we could get unemployment down to 1st quarter 2020 levels, everything would be fine," Giacomo Santangelo, economist at the employment platform Monster, said in an email earlier this week. "What we are finding now is while the unemployment situation has improved on a macroeconomic scale, individuals are facing rising prices that are threatening their standard of living."

Amid persistent inflation, the Federal Reserve earlier this week opted to raise interest rates further and announced the start of quantitative tightening, or rolling assets off the central bank's $9 trillion balance sheet. At his post-Fed meeting press conference, Fed Chair Jerome Powell expressed optimism that the moves would succeed in addressing some of the demand-side factors contributing to inflation and that, combined with some easing in supply-side constraints, these would help put a cap on rising prices.

"Wages are running high, the highest they've run in quite some time. And they are one good example ... of how tight the labor market really is," Powell said during his press conference Wednesday. "The fact that wages are running at the highest level in many decades. And that's because of an imbalance between supply and demand in the labor market."

"So we think through our policies, through further healing in the labor market, higher rates, for example of vacancy filling and things like that, and more people coming back in we'd like to think that supply and demand will come back into balance," he added. "And that, therefore, wage inflation will moderate to still high levels of wage increases, but ones that are more consistent with 2% inflation. That's our expectation."

Source: Yahoo Finance

No comments:

Post a Comment