My Blog List

Wednesday, May 28, 2025

Consumer Confidence Index

Wednesday, May 21, 2025

Leading Economic Index

On Monday, the D.C.-based research said that the index—a closely monitored composite of several economic indicators—had fallen by 1.0 percent to 99.4 in April, registering the fifth consecutive monthly decline and the steepest drop since March 2023. Over the six months ending in April 2025, the LEI fell by two percent, matching the pace of decline posted over the previous six months.

The sharp decline in the LEI is one of the several warning signals that have emerged from the U.S. economy in recent months against the backdrop of trade policy uncertainty and a related weakening in consumer sentiment.

Despite the U.S. and China agreeing to a temporary climbdown on tariffs, set to extend into mid-August, separate consumer surveys suggest that economic anxieties persist. Economists have expressed concerns that the trade dispute may have already done damage to both economies, while cautioning over the strong possibility of a re-escalation.

Seven out of the ten economic components of the LEI declined in April, most significantly consumers' expectations for business conditions. As Justyna Zabinska-La Monica, Senior Manager for Business Cycle Indicators at the Conference Board noted: "Consumers' expectations have become continuously more pessimistic each month since January 2025."

According to the University of Michigan's latest Consumer Sentiment Index, consumer sentiment dropped for the fifth consecutive month in May to 50.8, the second-lowest reading on record.

Sentiment has dropped by nearly 30 percent since January, with Republicans contributing significantly to the decline seen this month. Meanwhile, year-ahead inflation expectations rose from 6.5 percent in April to 7.3 percent in May, while long-run inflation expectations were pushed up to 4.6 percent, "reflecting a particularly large monthly jump among Republicans."

Many of those surveyed mentioned the impact of tariffs in their responses, though the University of Michigan notes that most were gathered prior to last week's joint announcement of a temporary reduction in tariffs by the U.S. and China. The reaction to this pause assessed so far, it added, "echoes the very minor increase in sentiment seen after the April 9 partial pause on tariffs, despite which sentiment continued its downward trend."

While the Conference Board's forward-looking LEI serves as a potential warning signal, the Coincident Economic Index (CEI)—which reflects current conditions—edged up by 0.1 percent in April to 114.8, following a 0.3 percent gain in March.

What People Are Saying

Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, The Conference Board, said: "The U.S. LEI registered its largest monthly decline since March 2023, when many feared the US was headed into recession, which did not ultimately materialize.

"Most components of the index deteriorated. Notably, consumers' expectations have become continuously more pessimistic each month since January 2025, while the contribution of building permits and average working hours in manufacturing turned negative in April. Widespread weaknesses were also present when looking at six-month trends among the LEI's components, resulting in a warning signal for growth."

Federal Reserve Chair Jerome Powell, during a press conference on May 7, said: "Despite heightened uncertainty, the economy is still in a solid position. The unemployment rate remains low, and the labor market is at or near maximum employment. Inflation has come down a great deal but has been running somewhat above our two-percent longer-run objective."

Powell continued: "The new Administration is in the process of implementing substantial policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation. The tariff increases announced so far have been significantly larger than anticipated. All of these policies are still evolving, however, and their effects on the economy remain highly uncertain."

Political economist Veronique de Rugy told Newsweek that despite the 90-day pause in U.S.-China tariffs, "the economic disruptions caused by the trade war have had tangible impacts, and the temporary nature of the agreement means that uncertainties persist."

Sean Metcalfe, associate director at Oxford Economics, said: "The effective tariff rate is still noticeably higher than that seen prior to President Donald Trump's inauguration. Over the span of several weeks, the US effective tariff rate skyrocketed to its highest since the late 1890s before settling slightly lower at a rate comparable with the 1930s. The bottom line is the US economy is still going to take a hit from the tariffs that remain in place."

Metcalfe told Newsweek that the tariff de-escalation would "boost GDP growth this year (relative to our previous forecast) by several 10ths of a percentage point, reduce the boost to y/y growth in consumer prices from tariffs by 0.2ppts, and nudge the unemployment rate lower by 0.1ppt-0.2ppts."

The Conference Board currently projects U.S. GDP to increase by 1.6 percent in 2025, slowed from 2.8 percent in 2024. It cited the adverse impacts of tariffs on America's growth prospects, with Zabinska-La Monica saying that the "bulk" of these will be felt in the third quarter of the year.

Source: Hugh Cameron, Newsweek

Monday, May 19, 2025

Moody’s Downgrading the U.S. Credit Rating

The move comes amid ongoing challenges associated with mounting U.S. debt and little sign of significant debt reduction in Congress, despite recent actions from the Department of Government Efficiency, or DOGE.

Moody’s decision to lower the U.S. credit rating to Aa1 from Aaa follows similar decisions by Fitch Ratings in 2023 and S&P Global in 2011. It also adjusted its outlook to stable from negative to reflect the downgrade.

“While we recognize the US’s significant economic and financial strengths, we believe these no longer fully counterbalance the decline in fiscal metrics,” said Moody’s statement.

The federal budget deficit totals nearly $2 trillion annually, accounting for roughly 6.4% of gross domestic product (GDP).

The move isn’t likely to have a big impact on debt markets, given Fitch and S&P Global’s downgrades did little to slow down demand for Treasuries. The 10-Year Treasury Note currently yields 4.44%, up from 3.62% last September. That's about where it was in the mid-2000s.

Nevertheless, the downgrade reflects growing concern that sky-high deficits and government spending will put upward pressure on Treasury yields, forcing rates on everything from credit cards to mortgages higher over time.

Moody’s decision coincides with President Trump’s cornerstone tax and spending bill, which is currently under consideration by the House of Representatives.

The bill extends President Trump’s 2017 tax changes, while also including new provisions, such as increasing the Social Security income tax deduction and eliminating taxes on overtime and tips.

While the bill is popular among many eager for additional tax relief, some GOP members have blocked the bill, hoping for steeper cost cuts to offset the tax breaks. In the crosshairs is Medicaid, which is already the subject of cost-cutting in the bill.

The tax proposals could boost long-run GDP by 0.6% but reduce federal tax revenue by $4.1 trillion from 2025 through 2034, according to the non-partisan Tax Foundation.

The proposed tax cuts boost deficits by $3.8 trillion over the same period, or by 1.1% of GDP.

Five republicans voted against advancing the bill out of the Budget Committee and to the House floor for a vote.

“Republicans MUST UNITE behind, ‘THE ONE, BIG BEAUTIFUL BILL!’,” wrote Trump in a post on Truth Social. "We don't need 'GRANDSTANDERS' in the Republican Party. STOP TALKING, AND GET IT DONE!"

Source: Todd Campbell

Inflation

Inflation was slightly lower than expected in April as President Donald Trump’s tariffs just began hitting the slowing U.S. economy, according to a Labor Department report Tuesday.

The consumer price index, which measures the costs for a broad range of goods and services, rose a seasonally adjusted 0.2% for the month, putting the 12-month inflation rate at 2.3%, its lowest since February 2021, the Bureau of Labor Statistics said. The monthly reading was in line with the Dow Jones consensus estimate while the 12-month was a bit below the forecast for 2.4%.

Excluding volatile food and energy prices, the core CPI also increased 0.2% for the month, while the year-over-year level was 2.8%. The forecast was for 0.3% and 2.8%, respectively.

The monthly readings were a bit higher than in March though price increases remain well off their highs of three years ago.

Markets reacted little to the news, with stock futures pointing flat to slightly lower and Treasury yields mixed.

“Good news on inflation, and we need it given inflation shocks from tariffs are on their way,” said Robert Frick, corporate economist at Navy Federal Credit Union. “Non-tariffed goods are still in the pipeline, and perhaps some importers have absorbed their tariff costs for now.”

Shelter prices again were the main culprit in pushing up the inflation gauge. The category, which makes about one-third of the index weighting, increased 0.3% in April, accounting for more than half the overall move, according to the BLS.

Thursday, May 8, 2025

Hogan Lecture at UNH Paul College

While not everyone can be Taylor Swift, Stevenson emphasized that this shift isn’t just cultural—it’s economic. Technological change, legal reforms, and global trade have redefined women’s roles in both work and family life.

“Economics has a lot to tell us about how that transition happens,” Stevenson said. “Each decision you make creates an interdependency that shapes the constraints for the next decision.”

Stevenson — a professor at the University of Michigan’s Ford School of Public Policy and former U.S. Chief Economist — walked through the factors that transformed household dynamics. Innovations like washing machines and prepared foods reduced the need for skilled domestic labor, while trade made clothing and other goods cheaper, reducing the economic value of traditional homemaking.

At the same time, policy changes — from the Equal Pay Act to Title IX — opened doors for women in education and the workforce. The result is a new model of marriage and family. Women are marrying later, choosing partners based on shared interests rather than economic specialization, and increasingly balancing career and parenting.

“We're getting an increase in the age of first marriage, particularly among those with greater market skills,” Stevenson noted. “It’s more optimal to wait until you know what your adult interests are going to be.”

Stevenson also pointed to recent data showing women now surpass men in education and rebounding in labor force participation after COVID. But she cautioned that more work is needed.

“Today’s families are struggling with policies built for a time when one person handled everything at home,” she said. Stevenson expressed hope that AI and modern workplace tools could offer new flexibility. “I want those AI robots to give you the space to be with your families — not replace you, but support you."

Stagflation: What Is It and Who Is at Risk?

The decision came at the close of the Federal Open Market Committee's meeting. Policymakers held the federal funds rate steady at a target range of 4.25 percent to 4.5 percent, where it has remained since December 2024.

The Fed's latest statement acknowledged increasing uncertainty.

"Uncertainty about the economic outlook has increased further," the FOMC statement said. "The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen."

This is the third consecutive meeting at which the Fed has held rates steady. It comes amid a trade war between the U.S. and China, in part after President Donald Trump implemented new, additional 145 percent tariffs on Chinese goods.

Further, Trump's trade policies have created some opposing pressures, complicating the Fed's moves.

While the FOMC statement did not reference tariffs, Federal Reserve Chairman Jerome Powell, speaking after the decision, said that given the scope of the tariffs, there will be risks of higher inflation and unemployment.

Regardless, Powell said he believes the Fed is prepared for how the tariff situation will play out, CNBC reported.

"There's just so much that we don't know, I think, and we're in a good position to wait and see, is the thing. We don't have to be in a hurry. The economy has been resilient. It's doing fairly well. Our policy is well-positioned," Powell said.

The decision to keep the federal funds rate steady was unanimous. The rate influences borrowing costs across the economy, including mortgages, credit cards, and business loans.

What Is Stagflation?

"Stagflation" is an uncommon but severe economic condition marked by stagnant growth, high inflation, and high unemployment, according to Fidelity Investments. The term merges "stagnation" and "inflation" and describes a scenario where prices rise even as the economy stalls or contracts.

According to Fidelity, stagflation's last major appearance in the U.S. came in the 1970s and early 1980s, driven in part by the oil embargo. In such conditions, the typical policy tools used to cool inflation, such as raising interest rates, can also worsen unemployment and sometimes suppress growth.

Who Is at Risk of Stagflation?

The implications of stagflation are broad, hitting both consumers and businesses. For households, purchasing power diminishes as prices outpace wage growth.

"Unless you're receiving regular raises to counteract inflation, your take-home pay may not be able to cover as much," Fidelity explained. "If unemployment is high, employers aren't likely to lift wages to compete for easy-to-find talent."

For investors, stagnation can drag on stock markets, as economic output slows and earnings decline. Meanwhile, fixed-income investments could be eroded by persistent inflation unless adjusted accordingly.

Businesses, particularly those reliant on imported materials or operating in industries with tight profit margins, may also suffer.

Earlier today, Trump doubled down on his position on China tariffs, saying he will not modify tariffs to initiate negotiations with the country.

As global markets respond to mixed economic signals, the next few months may prove critical in determining whether the U.S. economy can avoid a repeat of stagflation.

Source: Newsweek

Federal Reserve FOMC Meeting

Friday, May 2, 2025

Nonfarm Payrolls

The previous month's number, though, was revised down from +228K in its initial print. The BLS also revised February's print down by 15K to +102K, meaning that for the first two months of the year, there were 58K fewer jobs than previously reported.

The unemployment rate remained at 4.2%, as expected.

"The 177,000 increase in jobs and unemployment rate unchanged at 4.2% will strengthen the Federal Reserve’s no-action plan. It will likely hold rates, compared to earlier forecasts for a 25 bps cut at its May 6-7 meeting," said Chris Lau, Investing Group Leader for DIY Value Investing.

The labor participation force rate ticked up to 62.6% from 62.5%.

Health care, transportation and warehousing, financial activities, and social assistance continued to see increases in hiring, while federal government employment fell, the U.S. BLS said.

"The job increases in health care, transportation and warehousing, financial activities," Lau said. "DOGE activities led to a drop in federal government jobs. The government cut 9,000 jobs last month and 26,000 since January. The auto parts market lost 4,700 jobs. Although the government will lessen tariffs, be wary of industries with such headwinds. Investors should avoid firms like Magna (MGA), Advance Auto Parts (AAP), and Aptiv (APTV)."

Average hourly earnings rose 0.2% M/M in April, less than the +0.3% consensus, and slowing from the 0.3% increase in March. Y/Y, average hourly earnings increased 3.8%, less than +3.9% expected and +3.8% prior.

"Taken at face value, the April employment data displayed remarkable stability, leaving aside the question of the sustainability of that feature," said Mark Hamrick, senior economic analyst at Bankrate.

Equities reacted positively, with Nasdaq futures, S&P futures, and Dow futures each pulling up 0.9%. Bonds fell. The 10-year Treasury yield rose 6 basis points to 4.28%.

"While many will dismiss this report as 'the past,' these numbers suggest US economic resilience going into an uncertain period," said economist Mohamed A. El-Erian in a post on X. "With favorable supply and demand signals from the jobs report, it becomes virtually a certainty that the Federal Reserve will not cut interest rates next week."

Fitch Ratings' head of economic research, Olu Sonola, warns that economic uncertainty hasn't diminished. "For now, we should curb our enthusiasm going forward given the backdrop of trade policies that will likely be a drag on the economy," he said. "The key message coming from the totality of the data this week is that the U.S. economy was fundamentally strong through the first week of April, however, the outlook remains very uncertain."

Source: Liz Kiesche, Seeking Alpha

Thursday, May 1, 2025

URC at UNH

Wednesday, April 30, 2025

Recession ?

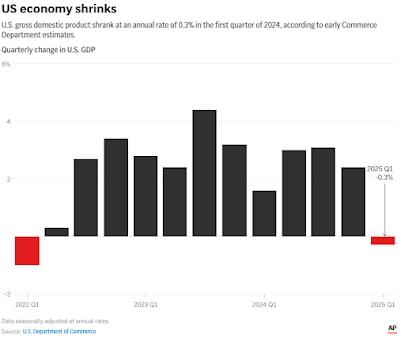

The January-March drop in gross domestic product — the nation’s output of goods and services — reversed a 2.4% gain in the last three months of 2024. Imports grew at a 41% pace, fastest since 2020, and shaved 5 percentage points off first-quarter growth. Consumer spending also slowed sharply — to 1.8% growth from 4% in October-December last year. Federal government spending plunged 5.1% in the first quarter.

Tuesday, April 29, 2025

Consumer Confidence

Saturday, April 26, 2025

Durable Goods Orders

The value of core capital goods orders, a proxy for investment in equipment excluding aircraft and military hardware, increased 0.1% last month after a revised 0.3% decline in February, Commerce Department figures showed Thursday. Shipments of core capital goods rose at a slower pace.

Bookings for all durable goods — items meant to last at least three years — surged 9.2%, the most since July on a 139% jump in orders for commercial aircraft.

The moderation in capital goods orders suggests companies were growing cautious about investing in their operations ahead of President Donald Trump’s early-April announcement of sweeping tariffs. A fluid trade-policy is fueling uncertainty elevated, leaving businesses’ capital spending plans in limbo while also raising concerns about the economic outlook.

In the meantime, while business leaders and investors wait for the administration to wrap up negotiations on a number of bilateral trade deals, lawmakers on Capitol Hill are still working on tax-cut legislation.

Metric Actual Estimate

Durable goods orders +9.2% +2.0%

Capital goods orders excl. defense & aircraft +0.1% +0.1%

Capital goods shipments, excl. defense & aircraft +0.3% +0.2%

Rather than orders that can be canceled, the government uses data on shipments as an input to gross domestic product, which reflects when a payment has been made. Core capital goods shipments rose 0.3% after a revised 0.7% gain.

Economists like to look at the core shipments figure for a cleaner sign of underlying sales since there are extremely long times between ordering commercial aircraft and military equipment and the actual shipment taking place.

Non-defense capital goods shipments including aircraft, which feed directly into the equipment investment portion of the gross domestic product report, dropped 1.9%, the most since October. The latest figure, dragged down by commercial aircraft, suggests a weak finish to the first quarter ahead of the government’s initial estimate of GDP next week.

After the durables report, the Federal Reserve Bank of Atlanta’s GDPNow forecast penciled in a 0.74 percentage point contribution from business equipment spending for the quarter, which would be the most in three years.

The Commerce Department’s report showed the increase in bookings for commercial aircraft, which are volatile from month to month, was the largest since July.

Boeing Co. said it received 192 orders in March, the most since the end of 2023 and up from 13 in the previous month. At the same time, China recently ordered its airlines not to take further deliveries of Boeing jets as the trade war escalates.

Manufacturing surveys suggest tougher sledding ahead. S&P Global’s flash April factory index hovered near stagnation for a second month. A gauge of Philadelphia-area manufacturing tumbled nearly 39 points this month and showed the steepest contraction in two years.

Source: Mark Niquette, MSN

Friday, April 25, 2025

US Economic Outlook - April 2025

Friday, May 31, 2024

Chicago Purchasing Manager's Index

The Chicago PMI assess the business conditions and the economic health of the manufacturing sector in the Chicago region. A value above 50.0 indicate expanding manufacturing activity, while a value below 50.0 indicate contracting manufacturing activity.

Let's take a look at the Chicago PMI since it began. The current level of 35.4 is below the level the index was at for the start of 6 of the 7 recessions that have occurred since its inception.

Personal Consumption Expenditures

Typically, Federal Reserve decision-making puts more weight on core inflation, which strips out volatile food and energy prices. The core PCE price index rose 0.2% in April, matching forecasts and the smallest increase so far this year.

The 12-month core inflation rate held at 2.8%, as expected.

On an unrounded basis, the core PCE price index rose 0.249%. At first blush, that's not as benign as the 0.2% reading. However, the big picture looks better. Thanks partly to downward revisions to first-quarter inflation data, the Fed's primary core inflation rate registered 2.75% over the past 12 months, which rounded up to 2.8%.

Core inflation hasn't been this low since March 2021.

Supercore Services Inflation

Still, the April inflation data showed that more progress is needed to bring down what Wall Street now calls supercore inflation. This metric unveiled by Federal Reserve chair Jerome Powell in late 2022 measures changes in core service prices excluding housing. This narrower view of price changes was in keeping with the Fed's worry that the tight labor market and elevated wage growth had been at the root of stubbornly high inflation. Wages make up a high percentage of costs for service businesses. Therefore, supercore services inflation should ease as wage pressures moderate.

In April, prices for these core nonhousing services, including health care, haircuts and hospitality, rose 0.265% on the month, after a 0.4% increase in February.

The 12-month supercore services inflation rate dipped to 3.4% from 3.5% in March, but though it is up from 3.3% at the end of 2023.

Personal Income, Spending

The PCE price index is released with the Commerce Department's monthly personal income and outlays report. Personal income rose 0.3%, matching forecasts. Personal consumption expenditures rose 0.2% in April, below 0.3% estimates. That followed back-to-back gains of 0.7%.

Adjusted for inflation, consumer outlays dipped 0.1% in April. That could lead economists to lower Q2 GDP growth estimates, after tepid 1.3% growth in Q1.

Federal Reserve Rate-Cut Outlook

After April's core PCE inflation data, market pricing showed 50.5% odds that the first Fed rate cut will come by the Sept. 18 policy meeting, up slightly from 49% ahead of the report.

Markets now see 58% odds of no more than one quarter-point rate cut for the full year, down slightly from 60%. That includes a 17% chance that the Fed will leave rates steady.

Source: Jed Graham, Investor's Business Daily

Thursday, May 30, 2024

GDP Growth

Economists had expected a slight downward revision in the second update, with the consensus forecast expecting GDP growth to be pruned to 1.2%. First-quarter GDP has fallen three-tenths of a percentage point since the preliminary report.

The latest update, the second of three, shows that first-quarter GDP growth was lower than the preceding quarter’s 3.4% clip.

The Bureau of Economic Analysis updates its GDP estimates over the course of several weeks as analysts get a better picture of how the economy performed during the first quarter.

The first quarter’s GDP reading is also a decline from all of 2023, which saw the economy expanded a healthy 2.5%.

The weaker growth in the first quarter was attributable in part to slower consumer spending. That could be a response to the Federal Reserve’s efforts to curb inflation by keeping interest rates higher for longer.

For months, economists have been expected GDP to slow down after the Fed raised its interest rate target to 5.25% to 5.50% in response to too-high inflation. Higher rates typically cause economic output to dampen.

But the previous few quarters of robust GDP numbers have given the Fed some ammunition to keep rates higher for longer, as has the underlying strength in the labor market.

The positive GDP growth has provided a talking point for President Joe Biden in his reelection bid.

The weaker growth in the first quarter was attributable in part to slower consumer spending. That could be a response to the Federal Reserve’s efforts to curb inflation by keeping interest rates higher for longer.

For months, economists have been expected GDP to slow down after the Fed raised its interest rate target to 5.25% to 5.50% in response to too-high inflation. Higher rates typically cause economic output to dampen.

But the previous few quarters of robust GDP numbers have given the Fed some ammunition to keep rates higher for longer, as has the underlying strength in the labor market.

The positive GDP growth has provided a talking point for President Joe Biden in his reelection bid.

Source: Zachary Halaschak, Washington Examiner

Consumer Confidence

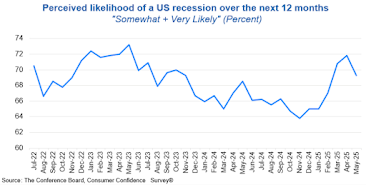

The mixed survey from the Conference Board on Tuesday also showed more consumers believed that the economy could slip into recession in the next 12 months. Nonetheless, consumers were very upbeat about the stock market and more planned to buy major household appliances over the next six months.

While the economy is expected to slow this year as a result of the cumulative impact of 525 basis points worth of interest rate hikes from the Federal Reserve since March 2022 to tame inflation, economists and most business executives are not forecasting a downturn.

"Continued positive job growth, rising wages, an ebullient stock market and healthy household balance sheets will keep consumers spending despite elevated prices and borrowing costs," said Oren Klachkin, financial market economist at Nationwide.

The Conference Board said that its consumer confidence index increased to 102.0 this month from an upwardly revised 97.5 in April. Economists polled by Reuters had forecast the index slipping to 95.9 from the previously reported 97.0. It outperformed the University of Michigan's sentiment index.

Confidence remains within the relatively narrow range it has been hovering in for more than two years.

The improvement was across all age groups, with consumers making annual incomes over $100,000 posting the largest increase in confidence. On a six-month moving average basis, confidence remained highest among the under-35 age cohort and those with annual incomes of more than $100,000.

Consumers' perceptions of the labor market also improved, with the survey's so-called labor market differential, derived from data on respondents' views on whether jobs are plentiful or hard to get, widening to 24 from 22.9 in April, though opportunities are probably not as abundant as in the past year.

"The level of this measure remains elevated by historical standards and points to a still strong labor market," said Michael Hanson, an economist at JPMorgan.

The measure closely correlates to the unemployment rate in the Labor Department's employment report. Labor market resilience, mostly characterized by historically low layoffs, is underpinning the economic expansion. Consumers' 12-month inflation expectations rose to 5.4% from 5.3% in April.

"Consumers cited prices, especially for food and groceries, as having the greatest impact on their view of the U.S. economy," said Dana Peterson, chief economist at the Conference Board. "Perhaps as a consequence, the share of consumers expecting higher interest rates over the year ahead also rose, from 55.2% to 56.2%."

About 48.2% of consumers in the survey expect stock prices to increase over the coming year, compared to 25.4% anticipating a decrease.

Stocks on Wall Street were trading higher, with the technology-heavy Nasdaq index (.IXIC), opens new tab breaching the 17,000 level for the first time. The dollar fell against a basket of currencies. U.S. Treasury prices were lower.